Smartphone Growth Metrics

Posted by Sam Churchill on November 5th, 2008Virtually half the planet has a mobile phone. They’re getting faster and cheaper as smartphones go downmarket.

In the third quarter of 2008, smartphone market share for Nokia fell to 38.9 percent in the quarter from 51.4 percent a year before, says Market researcher Canalys. Apple’s market share jumped to 17.3 percent and RIM’s to 15.2 percent in the quarter.

ComScore says iPhone adoption increased 46% among people who made between $25,000 and $75,000 per year. That’s because a $200 phone can save money in lieu of multiple digital devices and services. The market among rich people who earn $100K/year, is only one third that rate.

Faster, cheaper, more powerful.

Apple has recorded more than 200 million downloads through its App Store, which opened in July 2008, reports RCR Wireless News. The Android Market — which opened this October — may have already delivered its 3 millionth download, according to the ad firm Medialets. The average user of the Android-based G1 phone has downloaded 14 applications, out of 200 now available on the Android Marketplace, a Google executive said Wednesday.

Once developers can charge for their software in the first quarter of next year, 70 percent of the revenue will then go to developers. Of the remaining 30 percent, a small portion will cover the cost of the transaction, such as credit-card transaction fees, and most of the rest will go to the mobile operator.

Momentum appears to be building around Android with Motorola announcing it will shift focus on the Android platform in addition to Microsoft’s Windows Mobile. A WiMAX version is expected, too.

Symbian held 63% global market share in 2007, according to RCR News, with Linux 10% and Apple’s OS X on the iPhone garnering 3%. That was a year in which smartphones represented about 11% of total handsets shipped. This year, that picture shifts to Symbian with 53%, Linux/Android with 11% and Apple with 10%.

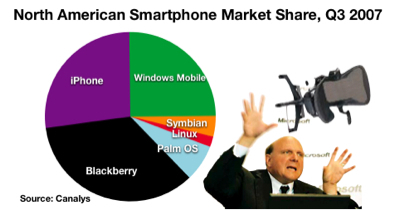

In the United States, however, the picture is quite different.

According to data from comScore/M:Metrics, Research In Motion’s BlackBerry leads with the largest installed base of users, followed by Windows Mobile, Palm and Apple, in Q3, 2007.

RIM topped them all in North America, selling 5.6 million units in the 2nd quarter with a 126% expansion. Windows Mobile grew at a respectable 20% — far outpacing Symbian’s 0.7% growth. Linux posted a disappointing performance, sliding 16% and ranking fourth behind Windows Mobile.

The iPhone 3G could turn those figures upside down.

The iPhone 3G could turn those figures upside down.

Apple sold 6.9 million iPhones in the third quarter of 2008, compared with 6.1 million BlackBerries sold over the same period. The company has sold roughly 200 million iPhone applications from its online AppStore in its three-plus months of existence. Unlike Google and Symbian, Apple and RIM are not open.

Samsung Electronics surpassed Motorola in the third quarter to became the largest mobile phone vendor in the United States, according to research firm Strategy Analytics. Samsung and LG Electronics control 22.4 percent and 20.5 percent respectively while Motorola, the top vendor in the U.S. since 2004, saw market share falling to 21.1 percent from 32.7 percent a year before.

The North American market is among the fastest-growing, with an increase of 78.7 per cent year over year in the 2nd quarter. The region also accounted for almost 25 per cent of the global smartphone sales to end users.

Worldwide smartphone sales totaled 32.2 million units in the second quarter, according to Gartner, up 15.7% from the same period last year.

By 2012, Strategy Analytics projects that smartphones will comprise 30% of all handsets shipped, or about 452 million out of 1.5 billion handsets. By then Symbian will still hold 39% of the smartphone OS market, with Linux/Android at 22% and Apple at 18%.

Nobody can predict the future. But smartphones will get faster, cheaper and better. End users and developers stand to benefit.

source : dailywireless.org

No comments:

Post a Comment