KKR to Buy Top ISP Domain Reg. “Go Daddy”- But who is KKR?

If you haven’t heard much about KKR (Kohlberg, Kravis, Roberts and Co) its probably not your fault. Like many Pac Man style private equity groups gobbling up vast proportions of businesses in every sector… They tend to be “publicity shy”, and like to operate in the dark of night, with a cloak of anonymity.

In other words, since they and other P.E.’s own much of the media designed to inform us of these matters, its not hard to keep things on the QT.

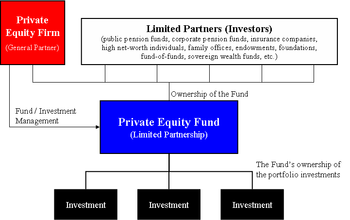

Private Equity basically means that since they have no stockholders to answer to, (except within the compartmentalization of the various individual companies they leverage)….They do not have to justify acquisitions and mergers… Which simply get announced in the back pages of newspapers. (They can also classify just who is investing in the myriad of companies under their control!)

According to an updated 2008 ranking created by industry magazine Private Equity International(The PEI 50), the largest private equity firms include The Carlyle Group, Kohlberg Kravis Roberts, Goldman Sachs Principal Investment Group, The Blackstone Group, Bain Capital and TPG Capital. These firms are typically direct investors in companies rather than investors in the private equity asset class and for the most part the largest private equity investment firms focused primarily on leveraged buyouts rather than venture capital.

(Thomas Lee Partners should definitely be mentioned here, and it is rather suspicious that they have been “omitted”)

Preqin ltd (formerly known as Private Equity Intelligence), an independent data providers provides a ranking of the 25 largest private equity investment managers. Among the largest firms in that ranking were AlpInvest Partners, AXA Private Equity, AIG Investments, Goldman Sachs Private Equity Group and Pantheon Ventures.

Yeah – You got it…. The “equity” they raise (at least in the case of AIG and Goldman Sachs) came out of your pockets through things like T.A.R.P and QE1,QE2, 3, 4, 5….. Thanks to the “Federal” Reserve.

In many circumstances these behemouths work together to pool their combined resourses in joint ventures. The Bain Capitol Partners / Thomas Lee buyout of Clearchannel is just one example.

The standard operating procedure for P.E. Co’s appears to be one of using connections and influence to drive the price down of said targeted company for takeover; and then use those same connections to grow the business to astronomical proportions… At this time it is either sold for profit, or used for more leverage.

These Private Equity firms also work together so they do not have to bid against each other, and this of course keeps prices down and eliminates competition. The charges of bid rigging are many.

Here is but one story of the above mention collusion:

Action alleges banks, private equity firms kept company prices low

Lawyers for the private equity industry are watching a consolidated antitrust class action alleging that 17 private equity companies and investment banks conspired to keep the price of target companies artificially low during a five-year period. The case recently survived a motion to dismiss, exposing to trial companies such as JPMorgan Chase and Merrill Lynch. The suit names some of the most prominent private equity and public investment players, including Bain Capital Partners and The Blackstone Group.The suit names some of the most prominent private equity and public investment players, including Bain Capital Partners, The Blackstone Group, Kohlberg Kravis Roberts & Co. and Thomas H. Lee Partners L.P.Eleven companies or their defense attorneys declined comment: Blackstone; the Carlyle Group and a couple of its funds; Goldman Sachs; JPMorgan; Merrill Lynch; Providence Equity Partners Inc.; Silver Lake Partners; Texas Pacific Group; Thomas H. Lee; and Warburg Pincus. Others did not respond to a request for comment, including Apollo Global Management, Kohlberg Kravis and Permira Advisors.

Most informed Americans know something about the Carlyle Group. Famous during the Bush Presidency (Both George Bush’s, Bin Ladens, Queen Liz among others…. were beneficiaries of 911 and the war on terror! What is rarely mentioned by Democrats these days is just how prominent Carlyle still is today in the Obama Admin!

So…. Here’s a question for ya: WHO DID COUSIN OBAMA APPOINT TO HEAD GM AFTER IT WAS “NATIONALIZED” er…. BAILED OUT?

Daniel F. Akerson was elected chief executive officer of General Motors Company on August 11, 2010. He became CEO effective September 1. Prior to joining General Motors, he was a managing director of The Carlyle Group and the head of global buyout. He served on the firm’s executive committee and was based in Washington, D.C. He joined the GM board of directors July 24, 2009. (source here)

Now…. All you Bush haters, and Obama Lovers….. PUT THAT IN YOUR PIPE AND SMOKE IT. While your at it go get some Dunkin Donuts because Carlyle owns that too! (sigh)

Bain Capital Partners might be of interest these days if for no other reason than the fact that Mitt Romney is a principle founder. Maybe THAT is why Romney is considered by the “Media” to be a front runner for the GOP Nomination for President of the USA! Starting off with Office Supply giant “Staples” – Bain has, in the matter of just a decade or so, shot to the top of the list of P.E. Firms!

And this can get really sneaky as we will see below. Bain owns Staples, Staples owns Whole Foods, etc…..

So – Getting back to our premise, WHO IS KKR?

Its 1980s deals included RJR Nabisco ($25 billion), Beatrice Foods ($6 billion), Safeway ($5 billion), and Owens-Illinois ($4 billion). Dealing continued in the 1990s with the Bank of New England, K-III Holdings (consumer magazines), and TW Holdings (Denny’s and Hardee’s restaurants).

Other holdings include American Re-Insurance, Duracell, First Interstate, Fred Meyer, Stop & Shop, Union Texas Petroleum, and Walter Industries (Hoover’s Handbook of American Business 1993, p. 360). It has also acquired the publishing and media operation, PRIMEDIA (including magazines like New Woman and Seventeen), diversified manufacturer Borden, online mortgage

lender Nexstar, Regal Cinemas which have more than 4,100 screens at about 430 theaters in more than 30 states, and the “in-schools” TV network , Channel One (see related article).Foreign subsidiaries picked up in the takeovers have included Del Monte Malaysia, Del Monte International in Panama and Bandegua (Guatemala), the Philippine Packing Corp., Associated Biscuits Malaysia, and RJ Reynolds Tobacco in Malaysia

Here is just a small snapshot of companies owned or operated by KKR. We only list the ones you will be most familiar with. (We suggest boycotting these companies if you love Freedom!!!)

BMG Music: (buys, or steals copyrights to popular music catalogs) – They have also ruined many a music career through careless and targeted shelving – I call this the “Illuminati Distribution Cartel” – They all mostly work together to allow certain music to be distributed to the public, while gate-keeping those who might contribute to a more “Aware” society. My Friends Gwen Mars were victims of BMG.

Del Monte Foods Co: Described as: One of the country’s largest producers, distributors and marketers of premium-quality, branded pet and food products for the U.S. retail market. U.S. retail market, generating approximately $3.7 billion in net sales in fiscal 2010. They claim to be Nutritionally conscious, but a quick look into the matter shows that they are one of the Largest distributors of GMO Foods for people and pets. Del Monte could be considered a major componant of the “Illuminati Food Distribution Cartel”.

Dollar General Corp: A customer-driven distributor of everyday items, including basic consumable merchandise and other home, apparel and seasonal products, with more than 8,000 stores in 35 states. (As of February, 2010)

This Company is cornering the market in the “Dollar Store” arena, which targets the nation’s poor (which grows in proportion with every passing day!).

This Company is cornering the market in the “Dollar Store” arena, which targets the nation’s poor (which grows in proportion with every passing day!).

Eastman Kodak: (bought cheap!) A Diversified group with a broad range of activities principally across film, photography, commercial printing and consumer electronics.

Energy Future Holding Corp: Manages a portfolio of competitive and regulated energy subsidiaries consisting of TXU Energy, a competitive electricity retailer, Luminant, a competitive power generation business, including mining, wholesale marketing and trading, and construction, and Oncor, a regulated electric distribution and transmission business. The Chairman is Don Evans. The Insider of insiders…. Appointed U.S. secretary of commerce by President George W. Bush. He is also a Senior Partner at QuintanaEnergy Partners, L.P. (conflict of Interest is a term that comes to mind.)

Remember VP Dick Cheney’s secret energy meetings before 911? Don was at a minimum a peripheral player.

On the Board of Directors of EFH is Thomas D. Ferguson who also is a managing director of Goldman, Sachs & Co. (See how this works?) Also on the board is Scott Lebovitz, yet another managing director of Goldman, Sachs & Co – Jeffrey Liaw (BoD) Mr. Liaw once worked for Bain Capital (those guys again) -Also on the board is: Marc S. Lipschultz (Goldman Sachs), Lyndon L. Olson, Jr.: Olson was a senior adviser with Citigroup Inc. (Rockefeller) from 2002 to 2008, after serving as United States ambassador to Sweden from 1998 to 2001. (He is also chairman of the board of the Texas Scottish Rite Hospital in Dallas) – Kenneth Pontarelli is a managing director of Goldman, Sachs & Co. in its principal investment. -

William K. Reilly – This guy is one of the most powerful people you may have never heard about! He is the MAN if you want to know who is driving the Agenda 21 car in the USA. (This is a massive scam to convince the public that these “barbarians” are all going green. Really they have just found a nicer way to kill you after sucking you dry!) He works directly for NWO Chief Prince Philip – Queen Liz’s hubby, who once stated that “he would like to be reincarnated as a deadly disease to kill off 80% of the global population”! Nice huh?) Accolades: Administrator of the U.S. Environmental Protection Agency (1989-1993), president of the World Wildlife Fund (1985-1989), president of The Conservation Foundation (1973-1989), and director of the Rockefeller Task Force on Land Use and Urban Growth from (1972-1973). He was head of the U.S. delegation to the United Nations Earth Summit at Rio in 1992. Mr. Reilly is Chairman Emeritus of the Board of the World Wildlife Fund, Chair of the Board of the ClimateWorks Foundation, Chair of the Advisory Board for the Nicholas Institute for Environmental Policy Solutions at Duke University, Chair of the Board for the Global Water Challenge, a Director of the Packard Foundation and the National Geographic Society and was Co-Chair of the National Commission on Energy Policy. He also serves on the Board of Directors of E.I. DuPont de Nemours and Company, ConocoPhillips, and Royal Caribbean International. In May 2010, Mr. Reilly was appointed by President Obama to Co-Chair the National Commission on the Deepwater Horizon Oil Spill and Offshore Drilling. He holds a B.A. degree from Yale, J.D. from Harvard and M.S. in Urban Planning from Columbia University. (all three ranking as the top NWO training centers)

Jonathan D. Smidt: Like many in KKR he was involved in KINDERCARE a cesspool of Ritual Luciferian abuse on children! Prior to joining KKR, Mr. Smidt was at Goldman Sachs & Co

*Most every board member of this colossal energy company (and that of the KKR “capstone”) has ties toGoldman Sachs, The CFR, UT, Stanford U (Tavistock) Harvard, and James Baker (Carlyle Group) Bush Crime Family Capo… Together they represent a whos who of the energy industrial complex, merging into banking, education, and healthcare.

*I cannot – for the sake of time – do such an extensive diagnostic of each KKR holding… But the pattern continues in each company. This, I believe, makes it easier for a small group of people to own and control EVERYTHING! (To see ALL of KKR’s holdings go to the KKR website.)

Here are some more of the most well known KKR holdings FYI:

Sealy Corp: The largest bedding manufacturer in the world. It markets a broad range of mattresses and foundations under the Sealy®, Sealy Posturepedic®, Stearns & Foster®, and Bassett® brands.

Seven Media Group: 50/50 joint venture with Seven Network Limited that consists of Australia’s leading free-to-air TV network (Seven Network), second-largest magazine business (Pacific Magazines), and second most-visited entertainment portal (Yahoo!7) through a 50/50 joint venture that was formed with Yahoo in February 2006.

TASC: A premier provider of advanced systems engineering and advisory services across the Intelligence Community, Department of Defense and civilian agencies of the federal government.

Toys R Us: One of the leading specialty toy and children’s products retailers in the world, selling merchandise through a worldwide network of stores as well as online. Subsidiary Babies “R” Us is the largest baby product specialty store chain in the world. Cradle to Grave! (Co OWNED with Bain Cap. Partners!)

US Food Service Inc: The second largest broadline foodservice distributor in the U.S., providing food and related products to independent restaurants, healthcare and hospitality customers, educational institutions and prominent multi-unit restaurant companies.

Vats Liquor Chain Store Management Co : The largest nation-wide liquor chain store operator in China

The Neilsen Co BV: A global information and measurement company active in over 100 countries, with leading market positions and recognized brands in each of the company’s core segments, including What Consumers Watch (media audience measurement and analytics), What Consumers Buy (consumer purchasing measurement and analytics) and Expositions (trade shows).

Hospital Corporation of America (HCA) is the largest private operator of health care facilities in the world, It is based in Nashville, Tennessee, United States and is widely considered to be the single largest factor in making that city a hotspot for healthcare enterprise. In 2006, Kohlberg Kravis Roberts and Bain Capital, together with Merrill Lynch and the Frist family (That is Sen Bill Frist) The Company was nearly wrecked via FBI investigations just before the Merger (a buyout even larger at the time to the RJ Reynolds / Nabisco merger)

One wonders how much influence these people have on National healthcare Policy.

LETS TAKE A PEEK AT WHO THE PRINCIPLE FOUNDER OF KKR REALLY IS?

Co-Founder, Co-Chairman and Co-CEO, Kohlberg Kravis Roberts & Co.

Henry R. Kravis co-founded the firm in 1976 and is Co-Chairman and Co-Chief Executive Officer of KKR’s Managing Partner.

Member: Council on Foreign Relations / co-chairman of Columbia Business School / Founder of ‘Kindercare”, which was embroiled in a national scandal of ritual sexual abuse of children! (and much more) This extreme conditioning is often used to create MKUltra / “Monarch” style mind control slaves! Believe or not, they are still operating to this very day, and it should not surprise anyone that their logo is a thinly disguised pyramid and capstone, with a ref to Baal (bell):

Other motifs include pentagrams, butterflies (monarch program ref) etc…

My Friend Kris Millegan (who wrote Fleshing out Skull and Bones, and who owns the GREAT publishing house Trineday.com / and who’s dad was a deep cover intelligence asset… Wrote this about the Kravis family:

In 1948, when Prescott was looking for a job in the oil industry for hisson, the future US President, George Bush, he turned to his great friend, Ray Kravis, the father of HenryKravis, the very same man who today ownsKindercare through his company, Kohlburg,Kravis, and Roberts. Father Raywas the son of a British tailor who made a fortune through the oil industry.His specialty was tax accountancy and he invented a tax shelter whichreduced tax liability for oil companies by as much as 65%. He was verypopular with the classic Illuminati families and offered George Bush a job,although he later chose to work elsewhere.“I know George Bush well,” Ray Kravis said later. “I’ve known him since hegot out of school. His father was a very good friend of mine.”Ray Kravis also became closely associated with the Kennedy family and themega-crook, Joseph Kennedy, the Illuminati father of JFK, made him managerof the family fortune. Kravisand Joe Kennedy were often golf partnersduring their winters in Palm Beach.

WebsterTarpley and Anton Chaitkin, in their outstanding book, George Bush, the Unauthorised Biography, said:

that thebusiness techniques of father Ray were passed onto his son, Henry, the ownerofKindercare. They write:“Such activity imparted the kind of primitive-accumulation mentality thatwas later seen to animate Ray Kravis’s son Henry. During the 1980s, as wewill see, Henry Kravis personally generated some $58 billion in debt for thepurpose of acquiring 36 companies and assembling the largest corporateempire, in paper terms, of all time. Henry Kravis would be one of theleaders of the leveraged buyout gang which became a mainstay of the

political machine of George Bush”.During the Reagan-Bush and Bush-Quayle administrations, Kohlburg, Kravis, and Roberts (KKR), founded in 1976, compiled a fantastic empire through oftenforced takeovers of companies using apparently limitless borrowedmoney.Actor Michael Douglas was the former prep school classmate of Henry

Kravis, and it was his character that inspired Douglas’s portrayal of GordonGekko, the corporate raider in the Oliver Stone movie, Wall Street.

WHY THE “GO DADDY” BUYOUT SHOULD CONCERN US ALL

Private-equity firms KKR & Co. and Silver Lake Partners, along with a third investor (allegedly – Technology Crossover Ventures), are nearing a deal to buy GoDaddy Group Inc., a closely-held company that registers Internet domain names, for between $2 billion and $2.5 billion, people familiar with the matter said.

An announcement of the sale could come as early as next week, although a deal hasn’t been signed yet and the people cautioned that an agreement may not be reached. (source)

Go Daddy is an Internet domain registrar and Web hosting company that also sells e-business relatedsoftware and services. In 2010, it reached more than 45 million domain names under management. Go Daddy is currently the largest ICANN-accredited registrar in the world, and is four times the size of its closest competitor.

In 2007 and 2008, the company lobbied in favor of legislation that would crack down on unscrupulous online pharmacies and child predators. (THIS IS NOT SOMETHING MR KRAVIS WOULD LOOK FONDLY ON! (see above)

Bob (Robert) Parsons is the CEO and founder of The Go Daddy Group, Inc., a family of companies comprising three ICANN-accredited domain name registrars, including flagship registrar GoDaddy.com, reseller registrar Wild West Domains and Blue Razor Domains. Other affiliated companies include Domains by Proxy Inc., a domain privacy company, and Starfield Technologies, the business’s technology development arm.

Right now KKR and partners are busy doing all they can to shut out any other potential buyers, while painting Bob Parsons to be an unstable nut bag in an attempt to drive down confidence, and therefore the price. It is in every sense PSYCHOLOGICAL WARFARE!

If these pac-maniac vampires get a hold of Go Daddy, they will have effectively taken control of a huge section of the internet. If needed they can shut down or “accidentally” delete websites, cancel domains, or tamper with sites unfriendly to their friends.

Of course when the inevitable “E Pearl Harbor” hits the web, KKR and friends will be the first to sign on to the already prepared “E Patriot Act“. In the mean time data-mining, surveillance, and sabotage can all be in a days work for KKR overlords.

THEY OWN YOU

The corporate conflation existing in these private Equity companies makes it harder for the average citizen to know who owns what. On thing we have learned over the years is by cross referencing the Board of Directors in any of the various holdings, we can get a pretty good glimpse of the fascist leaning of “Cartel Capitalism” (which cannot, and should not EVER be confused with Free Market Principles of someone like myself or Ron Paul for that matter.)

Back in 2002 with the help of researcher than has long since “disappeared” … I stumbled on a company (WFE) that claimed to own almost everything in every sector of life. Education, Finance, Health, Technology, Media, Arts and music…. You name it, they had some of it. At the time they were working with Warren Buffet and others to corner the Silver market ( a feat too big even for them) When I began discussing this mega company that no one had ever heard of, and exposed their website…. Guess what? It disappeared. They simply vanished.

(I have since determined that they changed their name and put on a tighter mask.)

As early back as the 1970s we could see that the Rockefellers (for example) owned over 50% of all Pharmaceutical companies, and the majority of the Airlines. Because of newer “anti trust” laws, and the over all awareness of the public to be wary of such massive ownership in every sector (and control of the populace as a result) – The Industrialists have had to be a whole lot more sneaky in owning everything at once.

It is my sincere goal that articles like this help to spotlight this manipulation of markets, price fixing, and supply of quality goods, and services for the ultimate freedom of citizens around the world!

No comments:

Post a Comment