Quad Play in Flux

Posted by Sam Churchill on December 8th, 2008Telcos are gaining tv subs, cable companies are losing subs, and the satellite companies are slowing toward no sub growth, says RealMoney using figures from Kagan.

As of the third quarter of 2008, there were almost 100 million multichannel TV households. Cable has about a 66% share, satellite has 31%, and telcos just 2% to 3%. Satellite growth slowed sharply in the past two quarters and is expected to go toward zero in the next few quarters.

About 70 million U.S. households now have high-speed Internet. Cable has a 55% market share, which has grown slightly over the past year as its share of net adds has risen from the low 50s to the 70s. The telcos have fallen behind, because the competition has been about speed, and low-end DSL has become the new dial-up.

The U.S. now has over 102 million wireline access lines. Cable is also ascendant in wireline telephony. Over 6 million access lines have been lost in the past year, with the major telco losses rising from 6% year over year to 9%. The telcos have lost 11 million lines while cable has gained 5 million. Telcos still have an 82% market share, but cable telephony has become popular and accepted and now has north of 19 million subscribers.

So far the competition among cable and telcos has focused on features and bundles rather than price says RealMoney. Telcos do offer four-product bundles, but thus far wireless has largely remained outside the bundle.

This could change in 2010 if Clearwire is able to offer cable access to its network. With cable then offering a four-product bundle, the competitive dynamic could change. For example, cable is likely to offer a one-number solution whereby your wireless phone works on your home network when you are dialing from home.

The SNL Kagan study – “U.S. Multichannel Projections” – estimated that cable’s market share will drop from its current 64 percent to 59 percent by 2012 due to increased competition from telcos and satellite video providers.

The top five ISPs (AT&T, Comcast, Verizon (FiOS and DSL) and Road Runner/America Online), have a combined market share of 48.2 percent, says ISP Planet.

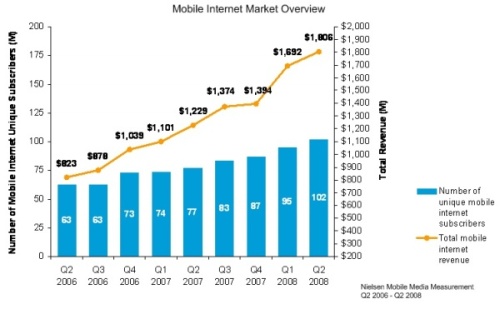

More than 90% of all U.S. mobile subscribers use either AT&T, Verizon, Sprint or T-Mobile. Mobile data is starting to take off. The 102 million mobile Internet subscribers represent 39% of global wireless subscriptions, and a 32% increase in year over year growth since Q2 2007.

Text messaging is still the leading data function, accounting for about 65% of total data revenue, according to Informa. But Nielsen reports a steady rise in the number of mobile Internet subscribers, and a faster increase in revenue. Only one in five subscribers surf the mobile Web, but some 37% of US adults age 18 to 24 use their phones to access the web, according to the Mobile Marketing Association.

UMTS (3G) is becoming widespread (see chart above), with more than 160 million UMTS subscribers worldwide on 203 UMTS networks in 85 countries. Informa Telecoms is forecasting there will be 1.3 billion 3G subscribers by 2012. But next generation “4G” (LTE) is OFDM-based, requiring a fork-lift upgrade and a duplicative, parallel network.

Four distinct groups emerged from ABI’s survey of attitudinal and behavioral segmentation: Tech-Savvy/TV-Averse, Online/On-A-Budget, Wireless Women on Web and On-the-Go Gadgeteers.

Umm, I got distracted with all the charts and graphs. What the point? I think this post was originally about cable operators offering wireless telephony. Time for another eggnog.

source: dailywireless.org

No comments:

Post a Comment