Verizon Jumps LTE Rollout

Posted by Sam Churchill on December 10th, 2008Verizon Wireless expects to begin deploying next-generation LTE (Long-Term Evolution) wireless broadband within a year, a top executive of the carrier said Tuesday.

“We expect that LTE will actually be in service somewhere here in the U.S. probably this time next year,” said Dick Lynch, executive vice president and chief technology officer of Verizon Communications, in a speech at Cisco Systems’ C-Scape conference in San Jose.

Since the LTE specification has not yet been finalized, most observers have predicted that a 2010 test is more realistic, with rollouts starting in 2011. AT&T intends to deploy LTE in 2012, reports Unstrung.

Still, Japan’s NTT DoCoMo said last month it would offer such a network commercially in 2010 and LG demonstrated 60Mbps download speeds on the world’s first LTE chips for cellphones and data cards, yesterday.

LTE, like WiMax, should deliver multiple megabits per second of throughput.

Verizon Wireless, a joint venture between Verizon and Vodafone, chose LTE in order to have a consistent 4G technology around the world. AT&T will first use HSPA+ (Evolved HSPA), an evolution of their current 3G technology before they start fresh with LTE.

“A femtocell of LTE or an access point of Wi-Fi is a really critical component of the way customers want their broadband delivered,” Lynch said. Verizon’s femtocells probably will include built-in Wi-Fi, Lynch added. That radio might be used by other devices in the home that don’t have cellular radios. Femtocells also transfer the backhaul expense to consumers.

Sprint Nextel has already deployed their “4G” technology with Mobile WiMAX now offered in Baltimore and Portland, Oregon. They will roll it out nation-wide through the newly formed venture, Clear. The next generation of Mobile WiMAX is 802.16m with speeds up to 1-Gbit/s fixed and 100-Mbit/s mobile, backward compatibility with Mobile WiMAX and “improved broadcast, multicast and VOIP performance and capacity.”

LTE, like WiMAX, will require a forklift upgrade. New infrastructure on the towers, new backhaul and new handsets.

Most importantly, Verizon needs wide-band spectrum. Verizon may tap their AWS band and 700 MHz band spectrum holdings for LTE. But even wider channels are necessary for high speed LTE.

AT&T and Verizon may be jumping the shark with LTE pronouncements. In the 700 Mhz auction, dual 6Mhz “A” & “B” blocks were purchased by phone companies with Verizon winning the largest “C” block (with dual 11MHz channels). That’s not enough for broadband LTE.

Wide channel (100Mbps) LTE just won’t fit on 700 MHz. It takes 20MHz per sector.

The FCC’s 700 MHz auction raised $19.6 billion for the U.S. Treasury with AT&T Wireless and Verizon Wireless accounting for the bulk ($16 billion). Here’s the FCC’s full list of 700 MHz winners. Commissioners Michael Copps and Jonathan Adelstein issued separate statements; (Copps and Adelstein).

| Source: Telephony

|

AT&T will cover 100 percent of the top 200 markets when their auction winnings are combined with their purchase of Aloha Partners’ 700 MHz spectrum. Combined with their AWS spectrum coverage, AT&T will now cover 95 percent of the U.S. population with new cellular licenses.

Verizon’s C-Block coverage (right) appears nearly total.

In a separate but related joint venture, Cox, Comcast and Time Warner Cable, previously picked up 137 AWS licenses covering almost 270 million potential customers in 2006’s Advanced Wireless Services auction (at 1.7/2.1 GHz).

Comcast was a big winner in the AWS auction. SpectrumCo, the cable venture formed to buy AWS frequencies, was the third highest bidder at the AWS auction in September, 2006. They paid $2.4 billion for 137 licenses in cities that include New York, Boston, Washington, Detroit and Atlanta. Sprint later got completely out of the SpectrumCo group.

SpectrumCo won 137 AWS licenses for $2.37 billion. Comcast’s share was $1.29 billion, followed by Time Warner Cable’s $632.2 million, and Cox’s $248.3 million. (See SpectrumCo Gets Licenses).

| Top 10 Highest AWS Bidders | |

| Bidders | Net total of high bids |

| 1. T-Mobile | $4.2 billion |

| 2. Verizon Wireless | $2.8 billion |

| 3. SpectrumCo | $2.4 billion |

| 4. MetroPCS | $1.4 billion |

| 5. Cingular | $1.3 billion |

| 6. Cricket | $710 million |

| 7. Denali Spectrum | $365 million |

| 8. Barat Wireless | $127 million |

| 9. AWS Wireless | $116 million |

| 10. Atlantic Wireless | $81 million |

| Click here to find out who is backing these bidders. | |

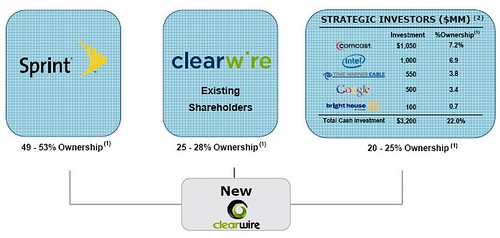

But Comcast has now invested more than one billion dollars in the Sprint/Clearwire/Google deal, with Time Warner cable investing another $550M, and Brighthouse networks in for another $100M. The cable/WiMAX deal has plenty of spectrum — and can utilize Sprint’s cellular infrastructure.

The fate of SpectrumCo, the venture that bought AWS frequencies for cable operators, remains to be seen. With Cox owning both 700MHz and AWS frequencies, they will likely utilize both in a wireless strategy. But Comcast and Time-Warner are moving towards 2.6GHz (with Mobile WiMAX). Building a separate AWS network with a different (incompatible) technology does not make a lot of sense economically or technically.

The SpectrumCo AWS licenses owned by Comcast and T/W could be for sale. Although it’s just idle speculation, if cable’s AWS spectrum was bought by AT&T (Cingular), then AT&T’s AWS holdings would more closely match Verizon’s.

This Monday, Chief Strategy Officer for Clearwire, Scott Richardson, told Dailywireless editor Sam Churchill that Clearwire also is leaving their options open for LTE (video to follow in a few days).

But is the company abandoning WiMAX? Not according to Richardson. It’s all about their spectrum asset. Clearwire has more than 100 MHz of choice 2.6 GHz spectrum in most major cities across the United States — but Clearwire only uses about 30 MHz per city.

Clearwire bought spectrum for 1/10th the cost per Mhz that cellular operators paid for AWS and 700Mhz bands…and Clearwire’s contract with Motorola insisted on infrastructure supporting both WiMAX and LTE.

Is Verizon Wireless nailing the coffin shut on WiMAX? I don’t think so. Clearwire has a lot of dry powder.

source: dailywireless.org

No comments:

Post a Comment